Tariff Blog Series: Tax Credit Opportunities Hidden in Your Supply Chain

September 4, 2025 By: David K. Teeple | Topics: Supply Chain, Tariffs

By Daniel Hyla & David Teeple

The Research & Development (R&D) Tax Credit has been a cornerstone of U.S. innovation policy for over four decades, but it has often been misunderstood or overlooked by industries outside of traditional research labs. With the passing of 2025 Reconciliation Bill (also coined the Big, Beautiful Bill) companies in warehousing, logistics, and distribution have a bigger opportunity than ever to capture meaningful savings from projects they are already investing in. At its core, the credit was designed in 1981 to reward businesses that commit to advancing technology and processes within the United States. While originally thought of as a benefit for pharmaceuticals, engineering firms, and high-tech startups, the credit has expanded over the years to include industries like supply chain where automation, robotics, and software are transforming how work gets done. In 2015, the Protecting Americans from Tax Hikes (PATH) Act made the credit permanent, and recent legislative changes have further reinforced its power by increasing payroll tax offsets for smaller firms, broadening the scope of qualifying activities, and ensuring that companies can apply for credits not only in the present but also retroactively for prior open tax years.

For warehousing and distribution in particular, the R&D Tax Credit can be tied directly to the projects companies are pursuing to stay competitive. A distribution center that develops or customizes a Warehouse Management System (WMS) to improve picking logic, integrates robotics into its fulfillment operations, or builds machine learning algorithms to allocate labor more effectively is doing work that meets the IRS definition of experimentation. Similarly, testing slotting strategies, modeling facility layouts through digital twins, or piloting automated storage and retrieval systems (ASRS) are examples of activities that may qualify. These aren’t routine IT installs or plug-and-play purchases, they involve uncertainty, technological principles, and a process of experimentation to reach a solution. That’s the key difference, and it’s what unlocks eligibility for the credit.

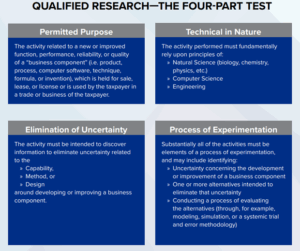

To help companies determine whether their efforts qualify, the IRS established a four-part test, as seen below1

The financial benefits can be substantial & act as a lever for continued growth. A mid-sized distributor that spends $2 million piloting robotics and developing custom WMS modules might find that $1.2 million qualifies as R&D spend. With a 7 percent effective credit rate (qualifying R&D costs typically range from 4.5% to 11% on average), that company could secure an $84,000 tax credit. On a larger scale, a national retailer investing $15 million across multiple facilities in automation and AI-driven labor management could see over $1 million in combined federal and state credits. Even small logistics startups benefit: a young company writing inventory optimization software with $500,000 in developer wages could offset $35,000 in payroll taxes annually, which is cash that goes straight back into growth.

Another unique advantage of the R&D Tax Credit is its flexibility in timing. Companies don’t need to budget for it in advance or wait for a new project cycle. At the federal level (and in some states), credits can be applied in the current year to reduce tax liability, or they can be claimed retroactively in any open tax years. For businesses that made heavy investments during the pandemic in robotics pilots, e-commerce fulfillment technology, or WMS enhancements, this retroactive feature can result in significant refunds today. In many cases, companies discover they have been leaving money on the table for years simply because they didn’t realize their activities qualified.

Of course, no incentive comes without scrutiny, and companies should be aware of the risks. The IRS has increased its focus on auditing R&D claims, particularly where industries are newer to the credit. The biggest risks include poor documentation, such as failing to track project activity or employee time accurately, as well as overreaching by claiming routine implementations as R&D. It is also common for companies to mistakenly include 100 percent of a project’s costs when only a portion of the work was experimental. The best way to mitigate these risks is to build strong documentation practices, maintaining engineering logs, technical specifications, and testing records, and to work with a tax professional experienced in supply chain-related R&D credits.

Now is the right time for companies in warehousing and distribution to take a fresh look at their projects through the lens of the R&D Tax Credit. With automation, robotics, and software innovation defining the future of logistics, most organizations are already performing qualifying work. The 2025 Reconciliation Act has made the credit more accessible than ever, with larger offsets, broader definitions, and retroactive claims available. And while the §174 rule change requires companies to spread deductions over time, the R&D credit can help soften that blow and free up cash for reinvestment.2,3 For companies willing to evaluate and document their efforts, the reward is clear: significant tax savings that can be allocated back into the very technologies driving the supply chain forward.

Let Sedlak & your tax professionals assist you in addressing these challenging times. With over 65 years of experience advising industry leading organizations, Sedlak will help you prepare for an ever-evolving future. Reach out to David Teeple at dteeple@jasedlak.com or Daniel Hyla at dhyla@jasedlak.com for more information.

Sources:

- 2025 R&D Tax Credit Qualified Research – Schneider Downs

- Section 174 Expensing Restored Under OBBB—A Win for R&D-Driven Businesses – Schneider Downs

- OBBB Section 174 Expensing – Further Guidance with a Tight Timeline for Small Businesses – Schneider Downs